Lk Bikes is the leading Bike to work retailer in the Northwest, and now we are shipping bikes all over Ireland.

We work directly with all goverment departpments amd major compaines. That combined with our large range of bikes and accessories we can taylor a bike to work package to suit your needs.

EMPLOYEE

How does it work?

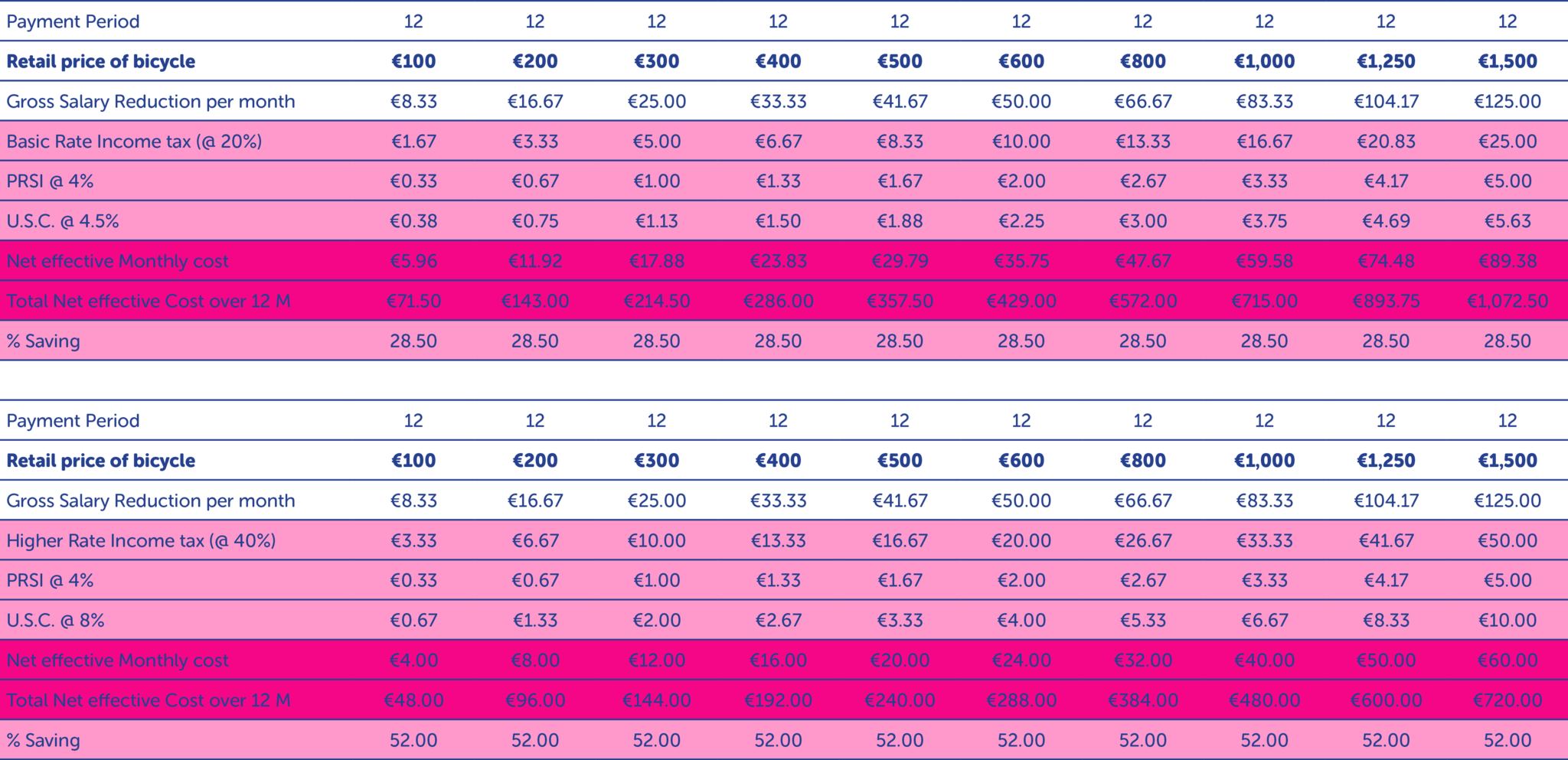

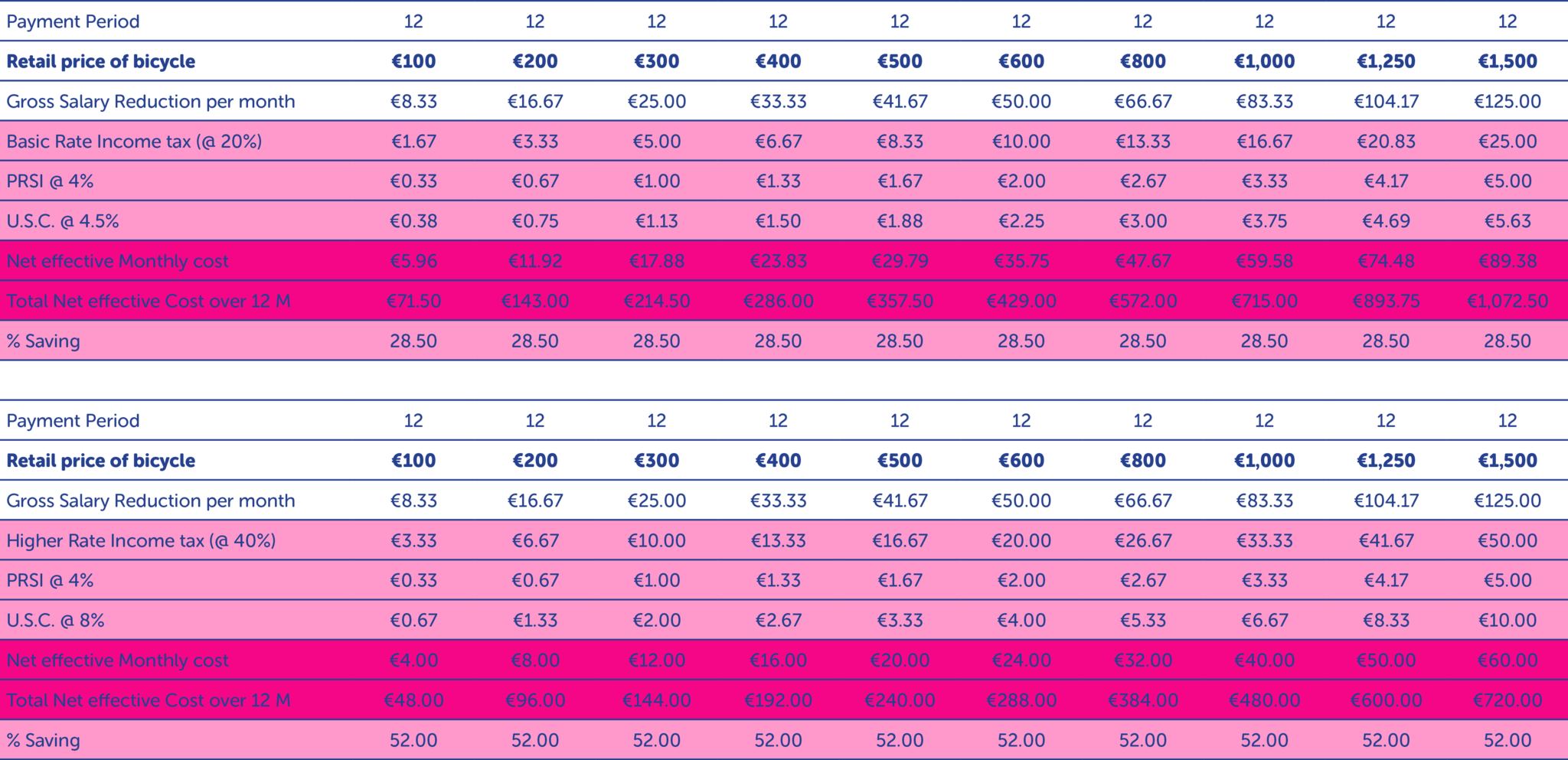

The Cycle to Work Scheme is a tax incentive scheme that aims to encourage employees to cycle to and from work. Under the scheme, employers can pay for bicycles and bicycle equipment for their employees and the employee pays back through a salary sacrifice arrangement of up to 12 months. The employee is not liable for tax, PRSI, levies, or the Universal Social Charge on their repayments.

How do I pay for the bicycle?

Usually, your employer pays the supplier for the bicycle and sets up a ‘salary sacrifice’ arrangement from your salary over an agreed time frame (no more than 12 months). This generally means that you visit the shop, select the equipment you wish to buy and have the shop invoice your employer directly for the cost. Note that the tax exemption does not apply if you pay for the bicycle and are reimbursed by your employer.

The repayment for the bicycle and equipment is then deducted from your gross salary (this means before income tax, PRSI, pension levies, or Universal Social Charge are deducted). These deductions can be made weekly, fortnightly, or monthly depending on your salary payment arrangement. Your employer can also buy the bicycle on your behalf and not require you to pay for it.

You can only avail of the scheme once in a 4 year period.

There is now new Limits as follows

-

-

-

-

- Cargo Bike €3000

- Electric Bike €1500

- Other Bikes €1250

- These limits also include accessories and related products.

What equipment does the scheme apply to?

-

- The scheme applies to new bicycles and pedelecs (electrically assisted bicycles which require some effort from the cyclist). It does not cover motorbikes, scooters, or mopeds.

- Purchase of the following new safety equipment is also covered:

- Cycle helmets which conform to European standard EN 1078

- Bells and bulb horns

- Lights, including dynamo packs

- Mirrors and mudguards to ensure that the rider’s visibility is not impaired

- Cycle clips and dress guards

- Panniers, luggage carriers, and straps to allow luggage to be safely carried

- Locks and chains to ensure cycle can be safely secured

- Pumps, puncture repair kits, cycle tool kits, and tyre sealant to allow for minor repairs

- Reflective clothing along with white front reflectors and spoke reflectors

Qualifying journeys

You must use the bicycle and safety equipment mainly for qualifying journeys. This means the whole or part (for example between home and train station) of a journey between your home and your normal place of work. Employers do not have to monitor this but you will be asked to sign a statement saying that the bicycle is for your own use and will be mainly used for qualifying journeys.

What the employer does:

Check if your employer will take part in the scheme. If they will, come to LK Bikes and pick out your bike and anything else you want.

-

-

-

-

- We will advise you which bike suits you best, whether you want comfort or speed, or both!

- We then give you an invoice which you pass on to your employer.

- When your employer pays us you can pick up your bike and accessories.

- Please note: Bikes must be picked up no later than 1 month, we cannot hold a bike for longer than that period.

- We do advise you to put a deposit on a bike and this is refunded when we get full payment from your employer, if no deposit is given we only treat this as a quote and will order/source a bike when we receive payment. (Please note with the current demand for bikes we highly advise putting down a deposit).

- Your employer will then deduct that amount from your gross wages over the coming year.

- If you are on the higher tax bracket and you want to purchase a bike/accessories for €1250 you get 50% off.

- Similarly, if you are on the lower tax rate you get approximately 30% off.